In a recent turn of events, industry frenemy Karhoo has announced that they have stopped trading and will be entering administration. This development is not only a significant blow to Karhoo’s employees and customers (travellers and travel brands) that depended on their transportation services, but also to the local transportation companies that relied on Karhoo’s business to sustain their communities and livelihoods.

Below, I will reflect on our industry dynamics and emphasize on what I believe to be one of the key threats towards creating and maintaining a sustainable environment for the full ground transportation value chain.

The Fragmented B2B Ground Transportation Market

The B2B ground transportation market is currently highly fragmented, with no established market leader. Each party active in selling ground transportation services has carved out its own niche through winning certain traveller demand contracts (i.e. OTAs, Tour Operators, Airlines, Travel Agencies). These demand generators require truly global operational coverage, the highest possible customer experience for their travelers, and, unfortunately, extremely low price points for contracting these services.

Currently, no provider of ground transportation services has achieved a truly globally covering network of suppliers. This lack of a comprehensive network has resulted in a landscape of volume-based interdependencies to provide global coverage to demand generators. To address this gap, ground transportation service aggregators (or: platforms) integrate with each other to extend their supply reach. While this allows aggregators to try to dominate the market, it even more so compromises the quality of pre-booked ground transportation services for travellers and it facilitates a race to the bottom on price.

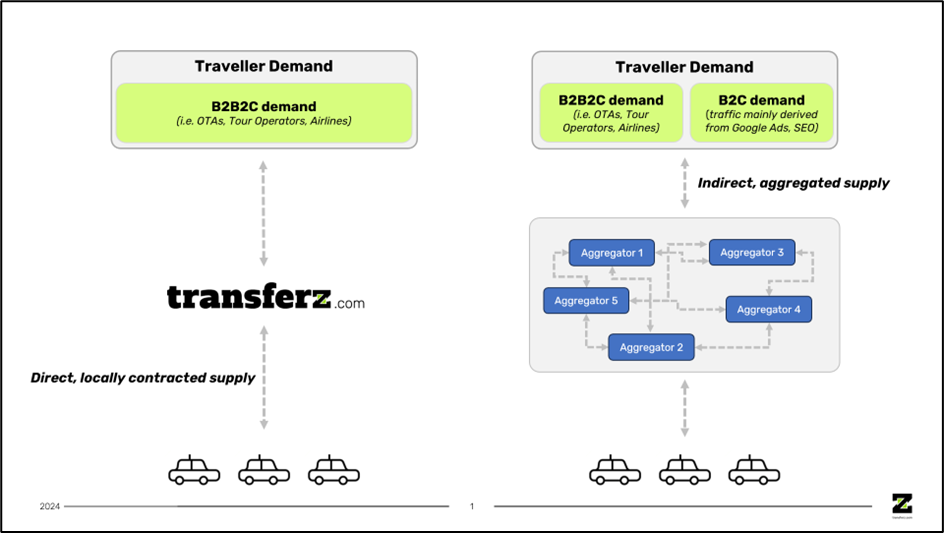

Let me illustrate this by providing a graphical overview below:

Schematically shown on the right, it is common practice to interchange supply and demand between platforms in the travel industry. While this approach might work for more static products like hotel inventory and flights, it falls short in the dynamic world of ground transportation. The introduction of (multiple) non-value-adding layers in a single transaction compromises the reliability of constant quality by failing to pass through the right operational details, such as the contact number and driver meeting point instructions, but also the oversight on adherence to service level agreements (e.g., driver waiting times, quality principles of vehicles) for all parties involved.

Another negative dynamic I mentioned earlier is the race to the bottom on price. Despite multiple layers and middlemen typically increasing costs, in our industry, prices are squeezed at the end of the supply chain. Travel brands push revenue pressure down the line, and whilst aggregators won’t give in, this harshly affects drivers who are crucial for providing the transportation service and supporting their local communities. Travel brands and aggregating platforms share a responsibility to counter this dynamic to sustain fair business practices and support local economies. Building long-term relationships with volume commitments and better payment terms can benefit the entire value chain.

At Transferz, we strictly go for direct supply, direct networks, and direct relationships, as shown on the left in the illustration. This not only allows us to control and optimize the quality of the delivered service but also ensures we can maintain a fair pricing model, which we call our Fare = Fair principle. We build our pricing from the bottom up, starting with an honest fare that allows local transfer companies to sustainably deliver transportation services.

Why We Believe the Pure-Play Aggregator Model is Obsolete

The pure-play aggregator model as described above has long been defunct, and the current setbacks in our sector are a testament to this. Middlemen add layers of complexity that detract from the value of the transportation services provided. The primary goal of pure-play aggregators is to lock in as many API integrations on both the demand and supply sides to push transactions in high volumes. However, as scalability often outpaces quality in these business models, little investment is made in ensuring the quality of the services delivered.

Quality-determining factors, driven by technology and strict operational processes are often compromised in the pursuit of speed and scale. Transferz advocates for direct supply, direct networks, and direct relationships. Fewer intermediaries mean cleaner and more complete dataflows, less information loss and better outcomes.

The Flaws of the Volume Game and How Transferz Builds to Last

It is concerning to see that many players in our industry still cling to the volume game—pursuing high volumes, low prices, and low margins without shouldering the operational costs necessary to deliver true quality of service whilst fighting for a sustainable living of their local suppliers. They bypass these costs to focus solely on topline growth. This approach is unsustainable and belongs to the pre-COVID era.

At Transferz, we focus on sustainable growth and profitability without compromising the ecosystem we operate in. This commitment extends through our teams and shareholders. To secure a long-term winning position, we continue to invest in acquiring the right talent, technology, and bringing highest quality to the market. We aim to grow profitable volumes and disrupt industry entanglements.

Our goal is to be a true partner to travel brands, local transfer companies, and their communities, ensuring that drivers who support their families can thrive and drive. We acknowledge that our journey started just 43 months ago, and we have not yet arrived at our destination, but we push ourselves every day to deliver sustainability and highest available quality, as we have a responsibility to our industry.

Safe travels!